With Carefull, MEFCU equips members with cutting-edge financial security tools amid rising fraud threats.

Merck Employees Federal Credit Union Partners with Carefull to Combat Rising Elder Fraud and Scam Threats

Media :

MEFCU

Paul Gentile

President

pgentile@merckefcu.com

Carefull

Becky Ross

Head of Marketing

press@carefull.com

Carefull, the award-winning financial safety service built to protect credit union members from elder fraud, the latest scams, and money mistakes, is proud to announce a strategic partnership with Merck Employees Federal Credit Union (MEFCU). As fraud reaches unprecedented levels, MEFCU is taking action to enhance member experience and security by offering Carefull’s unique suite of proactive account monitoring, identity protection, and issue resolution services to all members, their parents, and even next-generation caregivers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250212038687/en/

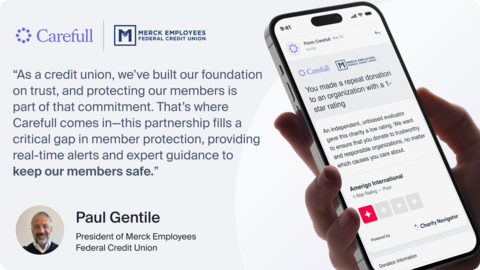

As fraud reaches unprecedented levels, Merck Employees Federal Credit Union is taking action to enhance member experience and security by offering Carefull’s unique suite of proactive account monitoring, identity protection, and issue resolution services to all members, their parents, and even next-generation caregivers. (Graphic: Business Wire)

“Fraud continues to grow and it’s only getting worse. We need to protect our members now from these increasingly sophisticated fraud schemes,” said Paul Gentile, President of Merck Employees Federal Credit Union. “Many members don’t realize they’ve been targeted until it’s too late. As a credit union, we’ve built our foundation on trust—and protecting our members is part of that commitment. That’s where Carefull comes in—this partnership fills a critical gap in member protection, providing real-time alerts and expert guidance to keep our members safe.”

Gentile stressed that timing, education and awareness is everything in protecting members against fraud and the Carefull service can play a role in all three of those areas. “Carefull alerts members of unusual transactions in a timely manner. That is key to prevent more fraud and also to recover funds. Carefull also educates members with fraud alerts and stories where members can learn. You would be surprised how eager members are today to learn how to better protect themselves and Carefull does that.”

With scams becoming more sophisticated and financial crimes specifically targeting older members, credit unions are facing increasing pressure to ensure their members remain secure. Many members—particularly older adults—do not regularly check their accounts, leaving them vulnerable to unnoticed fraud and unauthorized transactions. Carefull’s 24/7 account monitoring, alerts, and expert support give MEFCU members an additional layer of security and peace of mind.

“Credit unions have a unique responsibility to protect their older members and their financial futures,” said Todd Rovak, Co-Founder of Carefull. “Carefull was built with credit unions in mind—providing a simple, plug-and-play solution that enhances member trust, reduces fraud losses, and makes it easier for credit unions to offer real financial protection. MEFCU is setting the standard by acting now, this is the beginning of a larger industry shift towards financial institutions becoming the first line of defense in financial protection.”

This collaboration underscores MEFCU’s commitment to safeguarding its members, aligning with the credit union philosophy of “people helping people.” Beyond fraud prevention, MEFCU sees Carefull as an opportunity to enhance the overall member experience, helping credit unions deepen trust and strengthen member relationships.

Merck Employees FCU members can enroll in Carefull’s services immediately.

For more information about how Carefull helps credit unions protect their members, visit getcarefull.com.

About Merck Employees Federal Credit Union

Founded in 1936, Merck Employees Federal Credit Union (MEFCU) is a member-owned financial institution serving over 25,000 members. With a commitment to financial security, low fees, and exceptional member service, MEFCU provides a full range of banking solutions to help its members achieve financial well-being. For more information, visit merckcu.com.

About Carefull

Carefull is the first financial safety platform designed to protect aging adults, their families, and financial institutions from elder fraud, scams, and money mistakes. Built to support the unique needs of older adults, Carefull’s proprietary AI provides 24/7 account monitoring, a suite of identity and home protections, along with expert resources to help families. Credit unions use Carefull to deepen relationships across generations, provide proactive protection, and enhance trust with members navigating both aging and financial caregiving for older adults. Recognized for its innovation in financial safety, Carefull partners with leading credit unions to put financial care into financial services. Learn more at GetCarefull.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250212038687/en/

Business wire

Business wire

Add Comment