Nidec Announces its Execution of a Share Transfer Agreement on Linear Transfer Automation Inc. and its Two Related Companies, Canadian-based Press Room Equipment Manufacturer

Teruaki Urago

General Manager

Investor Relations

+81-75-935-6140

ir@nidec.com

Nidec Corporation (TOKYO: 6594; OTC US: NJDCY) (the “Company” or “Nidec”) announced today that its Board of Directors has approved a resolution to acquire the share of Linear Transfer Automation Inc., Linear Automation USA Inc., and Presstrader Limited, privately-owned Canadian companies (collectively the “Linear”), from its shareholders (the “Transaction of share”) on September 27, 2024 (Japan time). The Company execu

ted an agreement on the Transaction of share on September 30, 2024 (Canada time). The Transaction of share will be executed on October 1, 2024 (Canada time).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240930707546/en/

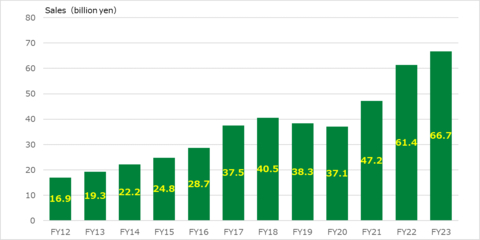

Nidec’s Press & Automation Machine Business Sales (Graphic: Business Wire)

1. Outline of the New Subsidiary |

|||

(1) |

Company name |

(i) | Linear Transfer Automation Inc. |

|

(ii) | Linear Automation USA Inc. | |

|

(iii) | Presstrader Limited. | |

(2) |

Headquarters |

Barrie, Ontario, Canada | |

(3) |

Established |

1994 | |

(4) |

Business leader |

Rama Jayaweera | |

(5) |

Business base |

Canada, United States | |

(6) |

Principal of businesses |

Manufacturing, sales and service for press peripheral equipment | |

(7) |

Number of employees |

90 (Consolidated) | |

(8) |

Sales |

39.6 million CAD (approximately 4.4 billion yen)

The fiscal year ended September, 2023 |

|

2. Linear’s Strengths

Linear is based in Ontario, Canada, and is a company that engineers, manufactures, integrates and provides services for in-line parts/material transfer and post-process automation equipment in the metal forming press room process. Linear’s main customers are major automobile manufacturers and Tier 1 and 2 suppliers, and Linear is supported by not only North American manufacturers but also major Japanese manufacturers for its technology, quality, and service. They also have strong ties with a wide range of other sectors in the North American market, including manufacturers of building materials and appliance.

3. Nidec’s Press & Automation Machine Business |

|||

(1) |

Company name |

Nidec Minster, Nidec Drive Technology (Kyori press-machine), Nidec Arisa, Nidec Vamco, Nidec SYS, Nidec CHS, Nidec Automatic Feed |

|

(2) |

Sales |

The fiscal year ended March 31, 2024 |

66.7 billion yen |

(3) |

Products |

Small high-speed presses, medium-sized presses, large presses, peripheral equipment |

|

(4) |

Manufacturing sites |

Japan, China, U.S.A., Mexico, Germany, Spain |

|

(5) |

Number of employees |

Approx. 1,400 |

|

4. Synergies with Our Group

Through our Nidec Press & Automation Businesses, we have expanded our press machine manufacturing, sales, and service business globally, as well as increased our lineup of presses and peripheral equipment products with M&As.

With the addition of Linear, we will be able to offer a wide range of products and services to our customers and pursue following synergies in terms of products, sales, and technology.

| (1) | As a comprehensive Press and Automation group, we are able to provide total system solutions by adding peripheral equipment for pre- and post-processing to the press machine itself and selling complete press lines to customers. |

| (2) | Sales expansion will be possible by selling our presses and peripheral equipment to Linear’s customers, and also by selling Linear’s products to our customers. |

| (3) | Linear’s products can be deployed to Europe and Asia markets utilizing Nidec’s global sales, service and manufacturing bases, which will enable shorter delivery times while also enabling us to improve the level of customer service in each region. |

5. Effect on Financial Performance for the Current and Next Fiscal Year

The transaction is expected to have no significant impact on the Company’s consolidated financial performance for this fiscal year ending March 31, 2025. If necessary, the Company will make additional disclosure on a timely basis in accordance with the rules of the Tokyo Stock Exchange upon determination of further details.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240930707546/en/

Business wire

Business wire

Add Comment